kansas sales tax exemption certificate

Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax.

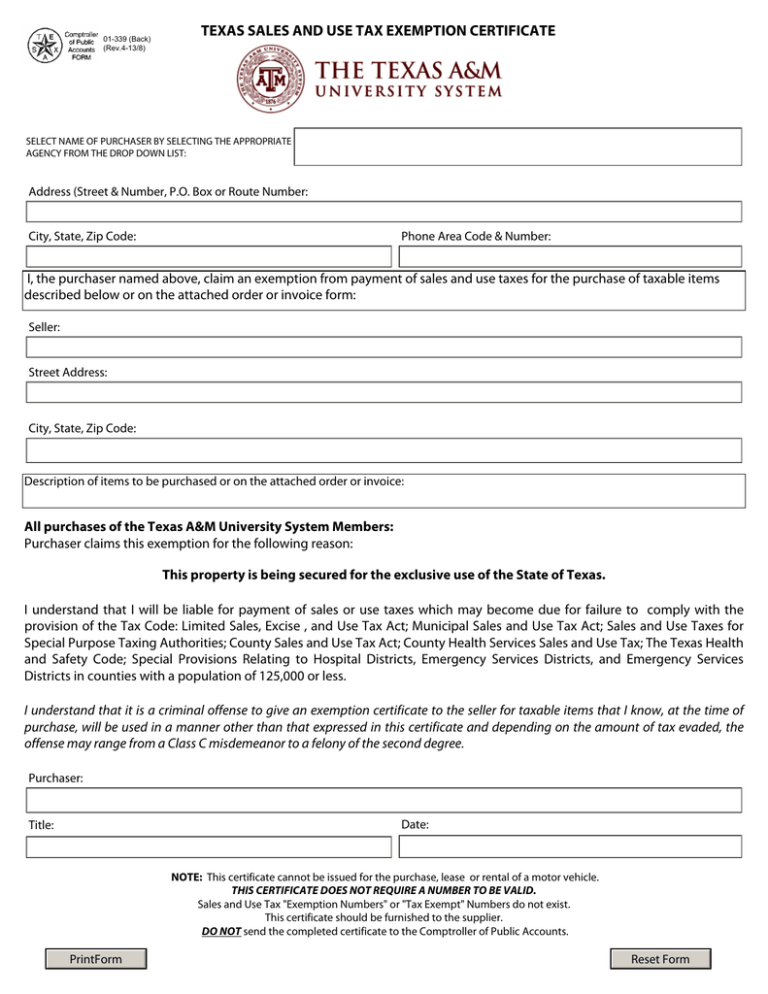

Texas Sales And Use Tax Exemption Certificate

It shows why sales tax was not charged on a retail sale of goods or taxable services.

. The information contained in this. Local sales rates and changes. File withholding and sales tax online.

Your Kansas Tax Registration Number. For other Kansas sales tax exemption certificates go here. If you have an SSUTA you can use this form as both a seller and a.

The buyer furnishes the exemption certificate and the seller keeps the certificate on file with other sales tax records. Make a tax payment. Certificate which can be provided to any vendorsupplier that shows KDA is exempt from sales tax.

Ad New State Sales Tax Registration. Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts. 2012-2016 Department of Agriculture Office Use.

WHAT IS AN EXEMPTION CERTIFICATE. Ad Create Edit Sign a Tax Exempt Certificate Today - Start By 515. The email address you used when registering.

How to use sales tax exemption certificates in Kansas. 79-3606fff exempts all sales of material handling equipment racking systems and other related machinery and equipment used for the handling movement or storage of tangible personal property in a warehouse or distribution facility in Kansas all sales of installation repair and maintenance services performed on such machinery and equipment. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates located at.

For other Kansas sales tax exemption certificates go here. Accessibility Policy Contact Web Master Terms of Use. KS-1550 Business Taxes for Agricultural Industries Rev.

The renewal process will be available after June 16th. Address tax rate locator. The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose.

Sales and Use Tax Entity Exemption Certificate The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. Sales tax exemption certificates may also be used to claim exemption from compensating use tax. To apply for update and print a sales and use tax exemption certificate.

Drop shipped to a Kansas location the out-of-state retailer must provide to the third party vendor a Kansas sales tax registration number either on this certificate or the Multi-Jurisdiction Exemption Certificate for the sale to be exemptIf the out-of-state retailer DOES NOT have sales tax nexus with Kansas it may provide the third party vendor a resale exemption certificate evidencing. Kansas Sales Use Tax for the Agricultural Industry at. For a Kansas sales tax exemption certificate to be provided to vendors for University purchases or for information regarding the Universitys sales tax exemption status in other states please contact KSU General Accounting office at 785 532-6202.

000-0000000000-00 Copyright 2017 Kansas Department of Revenue. Save Time Signing Documents from Any Device. An exemption certificate must be completed in its.

Government ST-28G Utility ST-28B Vehicle Lease or Rental ST-28VL Veterinarian ST-28V Warehouse Machinery and Equipment ST-203 Email here to order any Kansas tax form not available on. Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

The certificates will need to be renewed on the departments website. The purpose of this form is to simplify the reporting of your sales and use tax. Tax Policy and Statistical Reports.

Box City State Zip 4. The new certificates have an expiration date of October 1 2020. It shows why sales tax was not charged on a retail sale of goods or taxable services.

This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA. An exemption certificate is a document that a buyer presents to a retailer to claim exemption from Kansas sales or use tax. Kansas Sales Tax Exemption Certificate information registration support.

This use tax applies to purchases of goods from businesses in other states and its purpose is to protect Kansas businesses from unfair competition from. Printable Kansas Exemption. Destination-based sales tax information.

Be accompanied by a Kansas exemption certificate or Form PR-78SSTA. You must first be registered with Streamlined Sales Tax Registration System and have an account set up in order to use this form. Is exempt from Kansas sales and compensating use tax for the following reason.

This notice is available by calling 785-368-8222 or from our web site. Copy of prior-year tax documents. Presents to a retailer to claim exemption from Kansas sales or use tax.

Sales Tax Entity Exemption Certificate Renewal On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. _____ Business Name. Sellers should retain a.

Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. Street RR or P. Is exempt from Kansas sales and compensating use tax for the following reason.

You can download a PDF of the Kansas Streamlined Sales Tax Certificate of Exemption Form SST on this page. Passwords are case sensitive. If you are accessing our site for the first time select the Register Now button below.

A Kansas resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from. Select the application Add an Existing Tax Exempt Entity Certificate to this account.

And all sales of repair. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. A seller is relieved of liability for the tax if it obtains a completed exemption certificate from a purchaser with which the seller has a.

1320 Research Park Drive Manhattan Kansas 66502 785 564-6700. 18 rows In Kansas certain items may be exempt from the sales tax to all consumers not just. Sales and Use Tax Entity Exemption Certificate State of Kansas SAMPLE PR-78KS Streamlined Sales Tax Project Exemption Certificate PR-78SSTA Tire Retailer ST-28T US.

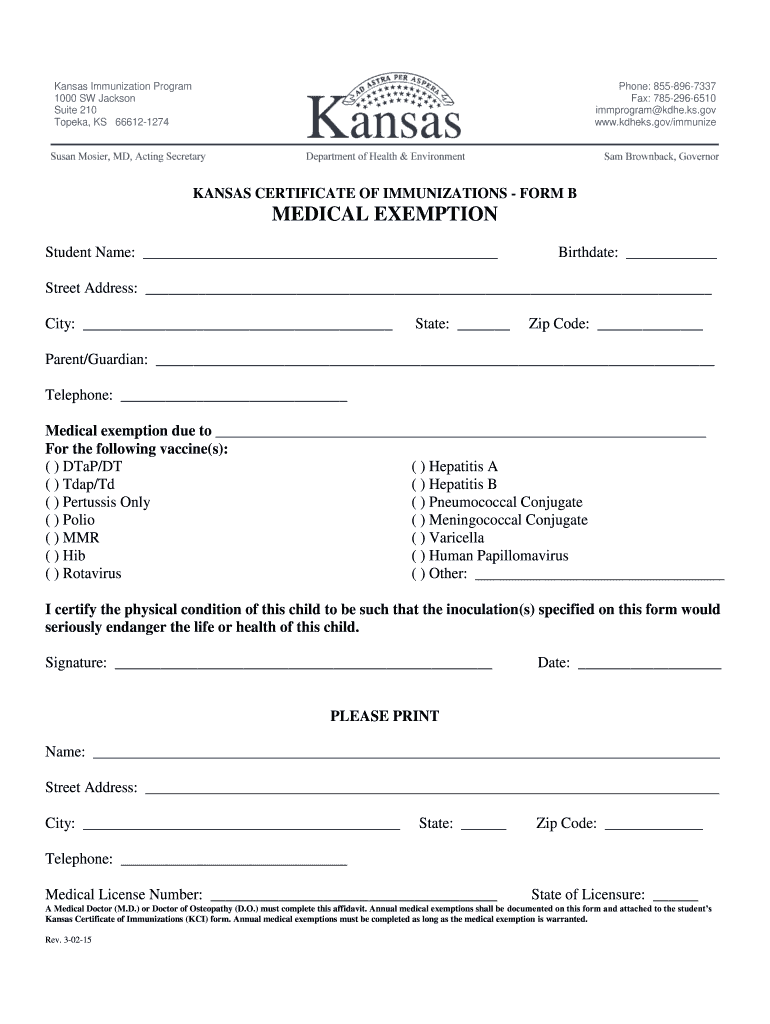

Ks Certificate Of Immunization Kci Form B 2015 Fill And Sign Printable Template Online Us Legal Forms

State By State Guide How To Get A Sales Tax Resale Certificate In Each State Taxvalet

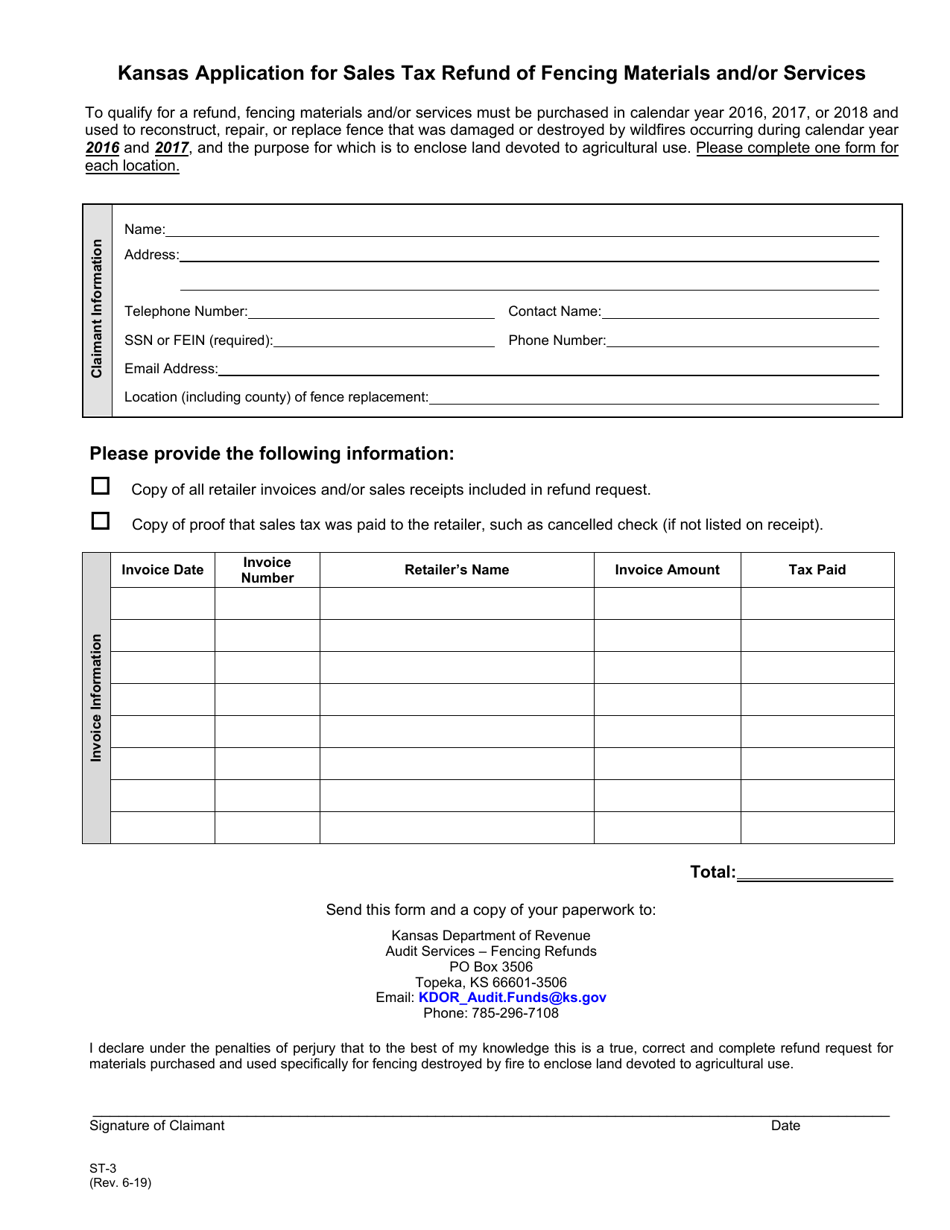

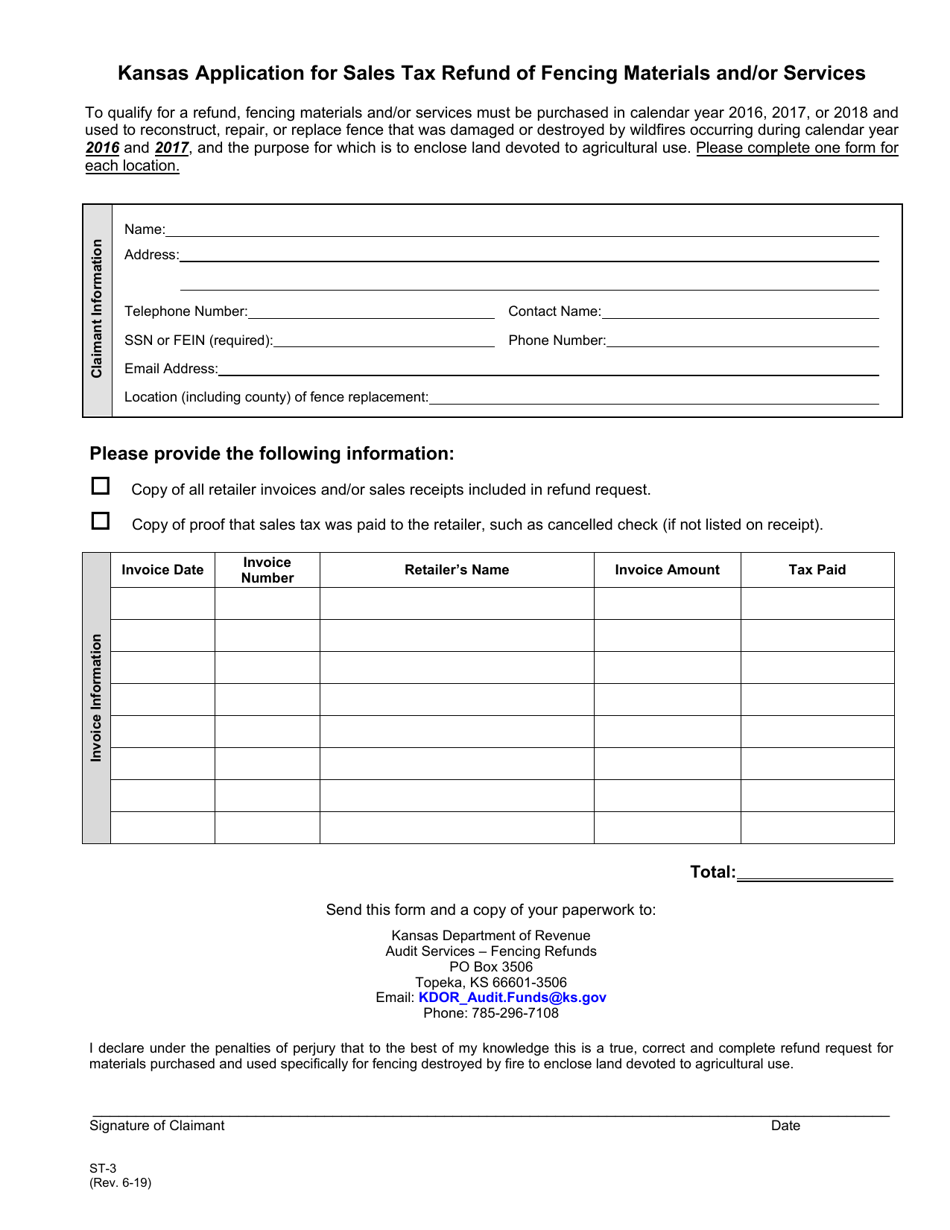

Form St 3 Download Fillable Pdf Or Fill Online Kansas Application For Sales Tax Refund Of Fencing Materials And Or Services Kansas Templateroller

How Do I Submit A Resale Certificate Or Tax Exemption Certificate Printful Help Center

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Form St 3 Download Fillable Pdf Or Fill Online Kansas Application For Sales Tax Refund Of Fencing Materials And Or Services Kansas Templateroller

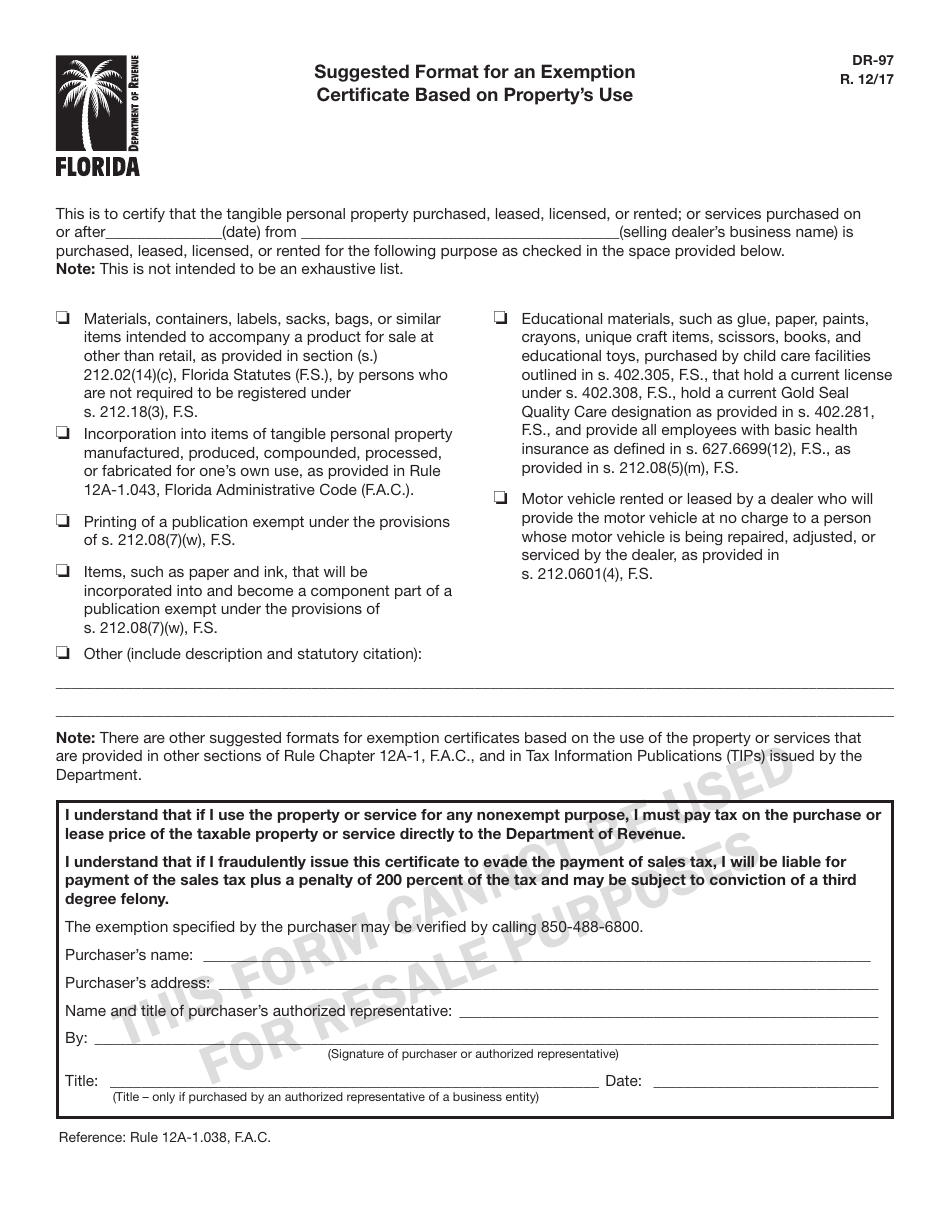

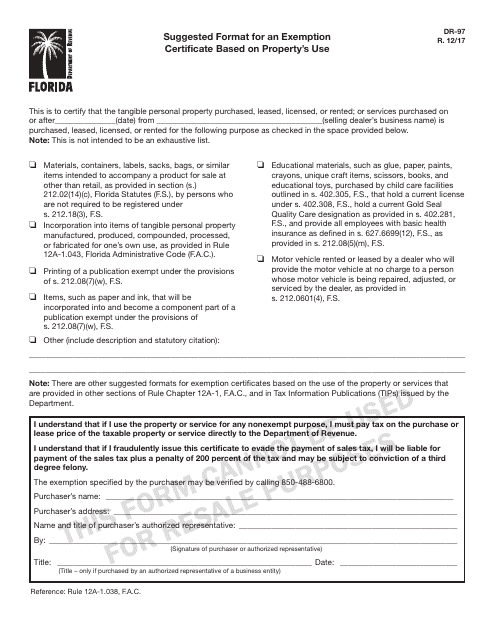

Form Dr 97 Download Printable Pdf Or Fill Online Suggested Format For An Exemption Certificate Based On Property S Use Florida Templateroller

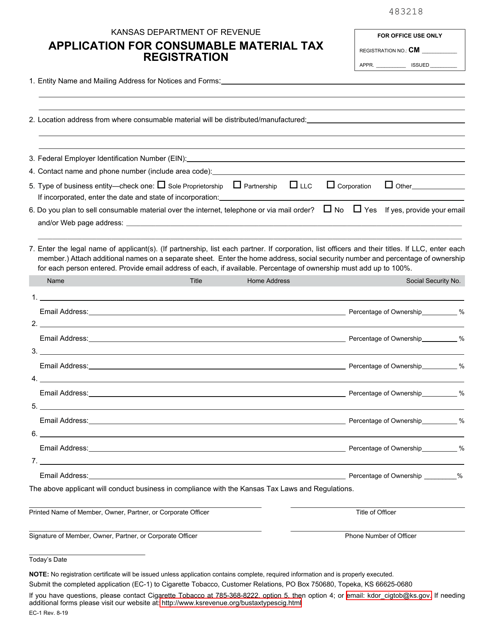

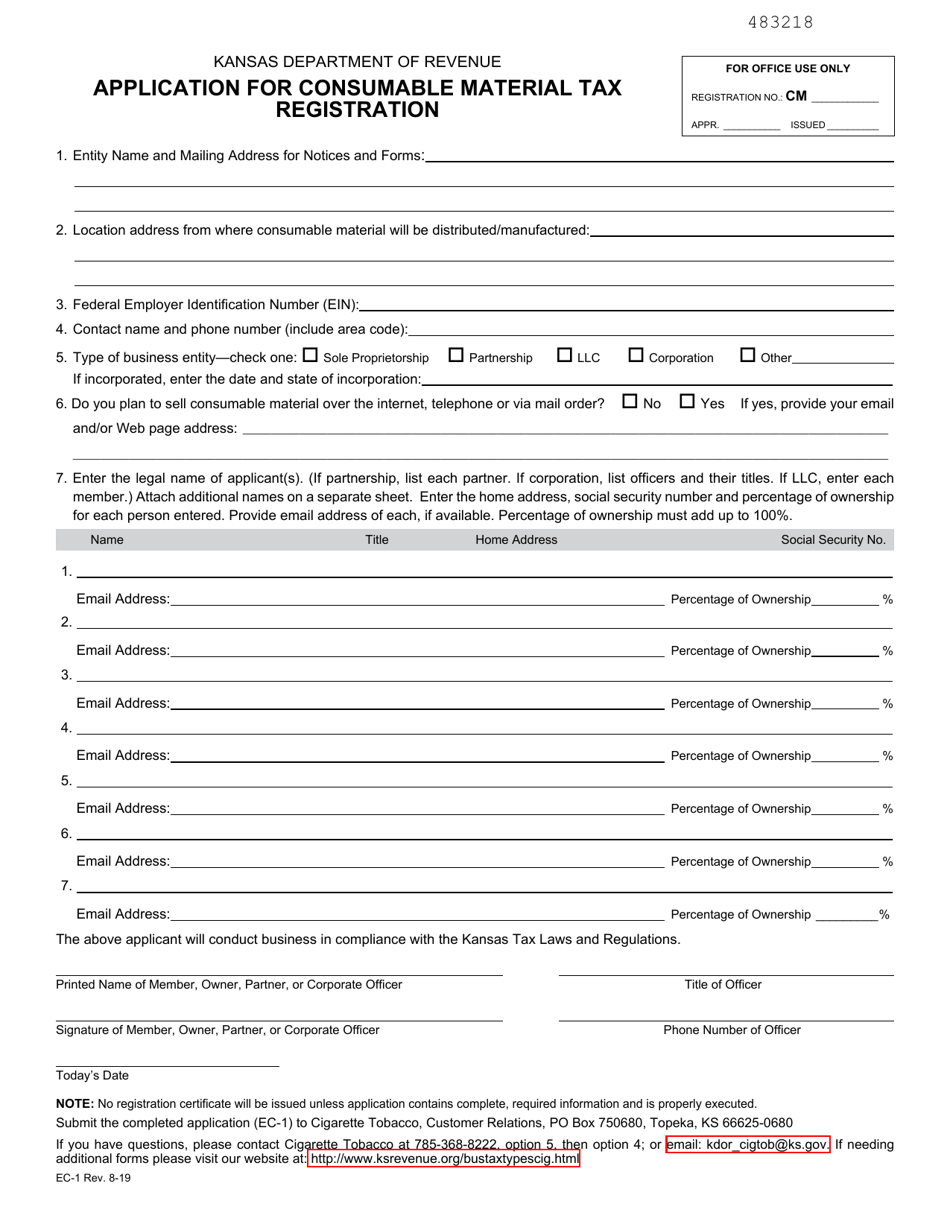

Form Ec 1 Download Fillable Pdf Or Fill Online Application For Consumable Material Tax Registration Kansas Templateroller

189 Car Sale Agreement Word Doc Page 4 Free To Edit Download Print Cocodoc

Form Dr 97 Download Printable Pdf Or Fill Online Suggested Format For An Exemption Certificate Based On Property S Use Florida Templateroller

Form Ec 1 Download Fillable Pdf Or Fill Online Application For Consumable Material Tax Registration Kansas Templateroller

Form St 3 Download Fillable Pdf Or Fill Online Kansas Application For Sales Tax Refund Of Fencing Materials And Or Services Kansas Templateroller

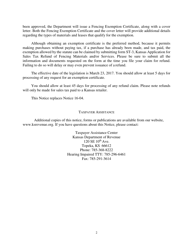

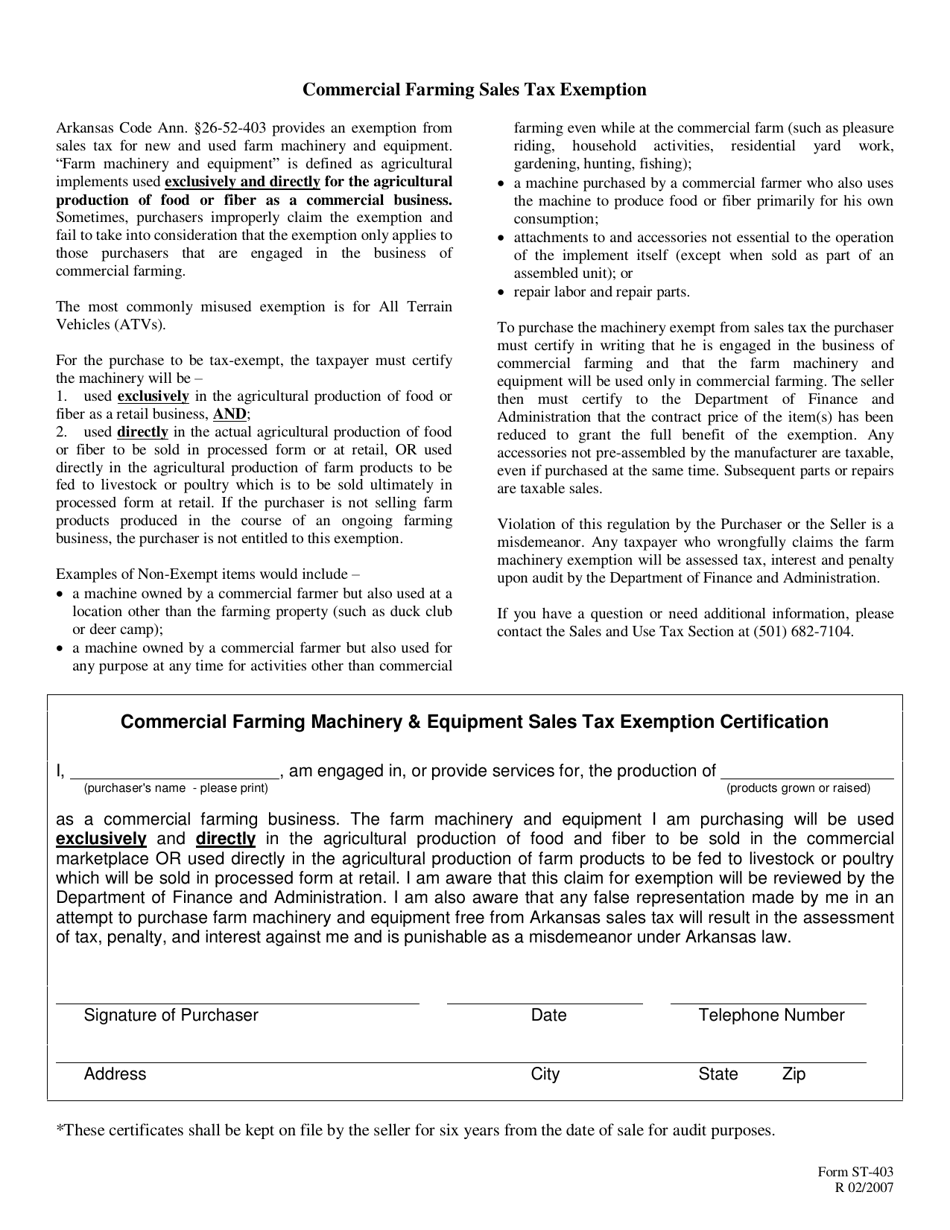

Form St 403 Download Fillable Pdf Or Fill Online Commercial Farm Exemption Certificate Arkansas Templateroller

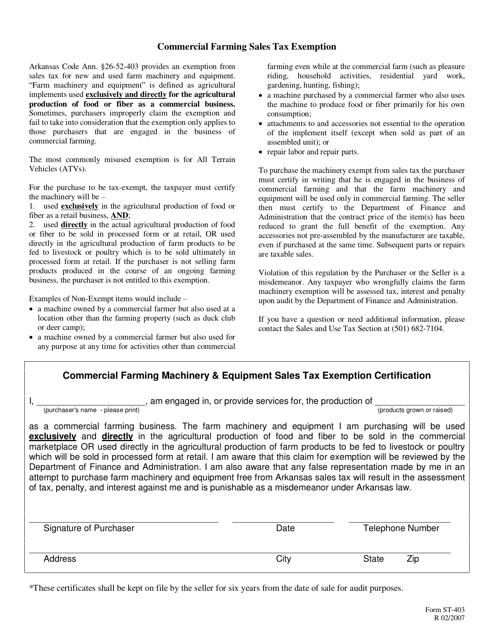

Form A4 Download Fillable Pdf Or Fill Online Employee S Withholding Tax Exemption Certificate Alabama Templateroller

Form St 3 Download Fillable Pdf Or Fill Online Kansas Application For Sales Tax Refund Of Fencing Materials And Or Services Kansas Templateroller

Form Ct 9u Download Fillable Pdf Or Fill Online Kansas Retailers Compensating Use Tax Return Kansas Templateroller

Form St 403 Download Fillable Pdf Or Fill Online Commercial Farm Exemption Certificate Arkansas Templateroller